Empowering SMEs with non-collateral finance, to micro-deal with Providers & Suppliers with smart technology

Wuood Fintech Ecosystem uses smart technology to connect entities in the supply chain and create smart lending contracts. Our investment concept empowers subscribers to enhance their market share and unlock new growth opportunities

Years of Experience

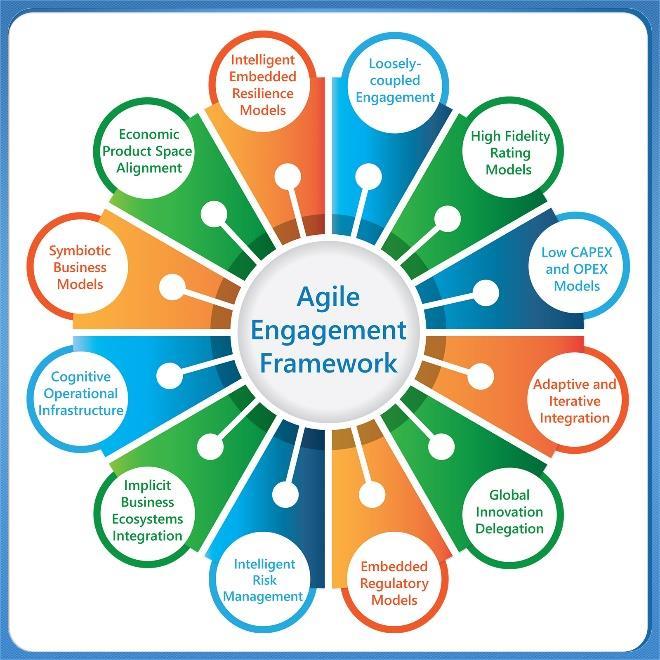

Wuood fintech was intrinsically architected to integrate with any financial and complementary institution via a single integration thread, and multifaceted agile engagement framework that consists of processes and models exclusively tailored by industry experts

Leverage SME to survive and grow in the current vibrant vulnerable economy

Continuous development of SME competencies using cutting-edge intelligent ecosystem

Empathy embedded services that symbiotically elevates customer values

-

HRM

HRM -

SVK

SVK -

VIM

VIM -

SES

SES -

DKD

DKD -

BLV

BLV

Computation of risks from 19 dimensions

Promotes the computation of real risks rather than pseudo-risks based only on financial parameters. Proactively manages risks by targeting potential risk dimensions

This promotes the dynamic creation of virtually large firms from diverse SMEs to address market requirements or specific demands. These Keiretsus are incepted dynamically, and evolve to handle demand dynamics.

Traditional business incubators are failing to achieve their ultimate goals and are both capital intensive, and slow.

VIM provides virtual incubation platform that accelerates the inception of new firms with minimum capital requirements.

EcoNet implements cascaded strategy model that comprises multiple systemic strategies, and derived firm level strategy.

SES promotes any SME to capitalize on the networked values via ecosystem strategy model.

To generate optimal values from SMEs we need to transform them from labour intensive to knowledge centric. DKD uses ontology driven framework to optimally manage the creation, and diffusion of knowledge.

Enable existing financial service providers to create a new business line for SME products without distorting their operations.

Fostering innovation of new products for incumbent financial services industries with the power of ecosystem-wide competencies, and lead-user driven innovation.

We have invested a fortune and top brass expertise to develop more than 60 wuood fintech products and services using multidisciplinary deep empathy-based innovation. checkout our implementation models.

Escalation

We formulate customer perceived values via deep analysis and mining of multi-dimensional perspectives that spans beyond our customers value spectrum. Wuood uses advanced artificial intelligence to identify the constraints of your business competencies and provide optimal solution that sustains and stimulate growth of your business.

Any questions? Contact us

Fintech Superpowers: How Fintech Helps Startups Thrive

Startups are the lifeblood of innovation and entrepreneurship, but they…

Why SMEs run out of money.

Starting and running a small or medium-sized business (SMB) is…

Power Of technology in SMEs

In today's rapidly evolving business landscape, small and medium-sized enterprises…

Wuood financial products are concieved and developed by experts from central banks, commercial financial institutions, Fintech, regulatory technology, artificial intelligence, computational finance, economic development, blockchain, and so forth. Besides, Wuood fintech was developed in alliance with globally competent experts with prestigious credentials from Harvard, MIT, Stanford, Oxford, London School of economics, Carnegie Mellon University.